Forex and CFD Swap Rates

The term swap comes up from time to time in the world of trading and can cause confusion. Part of the reason is that the word is used to refer to two different things. Swaps are a type of derivative trading product, but the word is also used to describe the interest that is either earned or paid on overnight CFD and forex trades.

In this article we describe both and clear up the difference, and then go into a little more detail on how swap rates apply to CFD and Forex trading.

Swaps as Trading Products

What is a swap and how does it work?

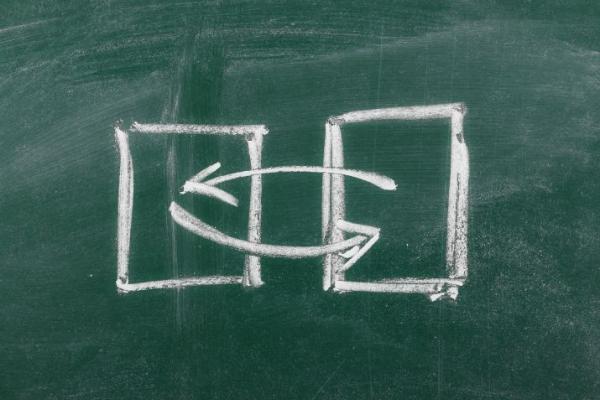

A swap is a derivative instrument which allows two parties to exchange cash flows, liabilities or price movements of two assets.

A simple example would involve two parties exchanging the cash flows of two interest rate products, such as bonds. One may pay a fixed rate, while the other pays a variable rate. If the holder of the fixed rate instrument believes rates may rise, they would be happy to receive the variable rate cash flows, rather than the fixed rate cash flows. If the holder of the variable rate instrument wants more certainty of the rate they will receive, they will be happy to exchange their variable cash flows for fixed cash flows.

Swaps allow institutions like pension funds, insurance companies and banks to manage liabilities and risk. They also allow hedge funds and traders to speculate on interest rates, currencies and other variables in the economy. They are generally traded on an OTC (over the counter) basis and are not listed on exchanges. This means the terms of each swap agreement are agreed by the two parties for each trade.

Types of swaps

- Interest Rate Swaps are used to exchange interest payments that are either paid or received. Usually one rate will be fixed, while the other is variable. They allow issuers of floating rate debt instruments to fix their liabilities and also allow funds to speculate on interest rate changes.

- Currency Swaps allow two parties to exchange the principal and interest payments of debt instruments. This allows parties to manage risk or speculate on interest rates and currency changes. They are used by central banks to stabilize currencies, and by corporations to manage their foreign exchange exposure.

- Commodity Swaps are used to exchange the spot price of a commodity for a fixed price, for a specified period. They allow producers and manufacturers that use commodities to manage their revenue and costs.

- Total Return Swaps are very similar to CFDs, but are used by institutions rather than retail traders. They allow two parties to exchange the price changes, in addition to the dividend and interest payments of an asset or pool of assets, for a fixed rate.

- Credit Default Swaps are like insurance policies that protect the holder of a bond in the event of default by the borrower. In the event of default, the seller pays the buyer the principle and interest payments they have lost.

Why to trade with Libertex?

- access to a demo account free of charge

- technical assistance to the operator 5 days a week, 24 hours a day

- leverage up to 1:500

- operate on a platform for any device: Libertex and Metatrader 4 and 5

- no commissions for extractions in Latin America