What Is a Market Maker?

Anyone who’s generally familiar with trading has heard about buyers, sellers, and brokers. But there is one type of market participants that often gets overlooked – market makers.

If you want to do well in this industry, you should learn who’s running the financial markets and who stands in your way. In this guide, we’ll be looking at market makers: everything from broad definition to common myths and trading advice.

Market Maker Definition

Market makers are also referred to as liquidity providers, which vaguely explains what they do. Market makers are usually large banks or financial institutions that keep the market functional by infusing liquidity.

In simple terms, they ensure financial assets could easily become “usable” money - if you want to sell an asset, they are there to buy it; if you’re going to buy, they can sell it. In turn, they profit from the bid-ask spread.

Market making is prevalent in currency exchange, where the participants tend to be banks and foreign exchange trading firms. In theory, an individual can also “make a market,” but the size of the investments needed is a big limitation. It takes enormous funds to be able to always stand at the ready to buy or sell.

Example of a Market Maker in Forex Market

Let’s say the current market price of EUR/USD is $1.05. Suddenly, there is news indicating that the EUR is going to rise. This should prompt individual traders to place market orders at $1.05. However, it’s safe to assume that there will be an influx of buy orders simultaneously.

A market maker, anticipating this behavior, sets the price at $1.10. Because of a high number of market orders, the market price can rise, let’s say, to $1.15, and because of the demand, fall back to $1.12. A market maker will then sell their EUR/USD inventory to meet peak demand at $1.15 and restock it when it drops to $1.12 for profit.

Types of Market Makers

Based on specialization, we can distinguish three types of market creators: retail, institutional, and wholesale.

Retail

This type arranges retail order flow and service customer orders coming from retail broker companies. In other words, they answer the needs of individual traders.

Institutional

Institutional market makers operate with larger block orders. These can come from mutual funds, pension funds, insurance companies, and asset management companies. This requires them to help a substantial inventory on hand.

Wholesale

Wholesalers trade assets in large volume pools. Trading is often carried out through a high-frequency trading algorithm that optimizes the bundling and spread arbitrage strategy. These firms are responsible for order flow arrangements and compensate brokerages.

How Do Market Makers Work?

Market makers control how many asset units (stock, currency, etc.) are available for the market. Based on the current supply and demand of said asset, they adjust the price.

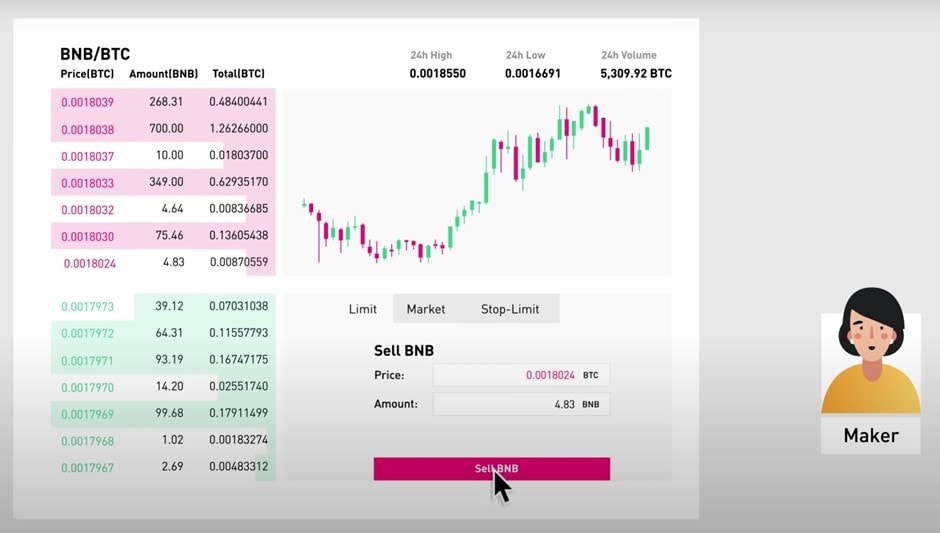

They provide liquidity for the order book by placing orders that can be matched in the future. Then, market takers (traders, for example) consume the inventory by taking the order from the order book.

Market makers are known to hold a disproportionately large number of an asset. The reason is they need to be ready for a high volume of orders in a short time at competitive pricing. If investors are buying, they are supposed to keep selling, and vice versa. Basically, they take the opposite side of trades that are being executed at any given point in time - i.e., act as a counterparty.

Each market has its own market creators. Meaning, each broker uses a quotation given by one or several market makers when offering prices to clients.

What Is the Role of a Market Maker?

To better understand what a market maker does, it is worth looking into the functions they perform in the market.

Price Continuity

Price continuity characterizes a liquid market with a relatively small bid-ask spread. Essentially, it’s a cornerstone of reliable market making. A market maker should be able to show the ability and willingness to make a price in a range of sizes, even in spite of significant volatility. Capital commitment and diverse distribution channels play an important role in that.

It should be noted that market makers don’t provide price consistency for altruistic purposes. Even though it contributes to the market’s health, they have their own stakes. Market makers tend to incur losses at times when the price continuity rule isn’t fulfilled.

Trade Continuity

Market makers need to have a continuous presence and provide the immediacy of dealing. Whenever an asset is bought or sold, there must be someone on the other end of the transaction.

If an institution offers real-time trading to its clients, a reputable market maker will facilitate this functionality.

Flexibility and Coverage

Market makers enhance their service by providing flexibility in a number of areas. Particularly, they can offer non-standard settlement dates and the opportunity to settle in multiple currencies.

Moreover, instead of only picking a handful of assets, a market creator has to cover a broad range of instruments to its clients. This proves the market makers’ commitment to client satisfaction.

Intermediation

By intermediary function, we imply several ways of intervening in the market:

- Serving as a link between sellers and buyers.

- Determining the opening price. At the start of a trading session, a market maker must define the optimal opening price.

- Actively quoting two-sided markets. According to market rules, a transaction can only be made with the participation of a market maker. Meaning, online quotes provided by market makers can be considered legitimate.

- Providing up-to-date information to all market participants. For example, on market prices.

- Maintaining market balance. There are times when sell orders exceed buy orders significantly. In these cases, market makers use their own funds to ensure the balance of orders.

Why to trade with Libertex?

- access to a demo account free of charge

- technical assistance to the operator 5 days a week, 24 hours a day

- leverage up to 1:500

- operate on a platform for any device: Libertex and Metatrader 4 and 5

- no commissions for extractions in Latin America