Elliott Waves: Surf the Market

The Elliott Waves' approach is one of the most popular among traders and investors all over the world. However, it’s not easy. Mr. Elliott invented plenty of wave patterns that should be drawn correctly. In this tutorial, we will help you create a simple system that you will use while trading.

Elliott Wave Theory: A Piece of History

Although the Elliott Wave principle was created in the 1930s, it still has been gaining popularity. Ralph Nelson Elliott, an economist, developed this theory while retired. His approach became famous when Mr. Elliott managed to foresee a plunge in the stock market.

Ralph Elliott based his approach on the behavior of traders. He believed that traders and investors repeat the same actions. Thus, market tops and bottoms can be easily predicted.

Elliott Wave Theory is based on the behavior of traders. Mr. Elliott believed traders and investors repeat the same actions.

Lots of Elliott Wave traders and analysts have been using this theory since Mr. Elliott passed away. Plenty of books and articles were published to describe principles of the Elliott Waves strategy. There is even a “school” of traders who are called “Ellioticians.”

We will sum up and provide you with the most relevant information that will help you “ride a wave.”

What Is Elliott Wave?

Elliott wave theory is an instrument of technical analysis which reflects traders’ psychology. This method differs from standard technical indicators, such as the RSI, MACD, etc. It’s a theory that doesn’t include calculations. As we mentioned above, Elliott Wave analysis assumes that market movements repeat. And waves just help a trader predict the future price direction based on the historical trends.

When you determine the waves on the chart based on the previous price, you will be able to define the further price direction.

There are plenty of types of Elliott waves. Still, the idea is the same: when you determine the waves on the chart based on the previous price, you will be able to define the further price direction.

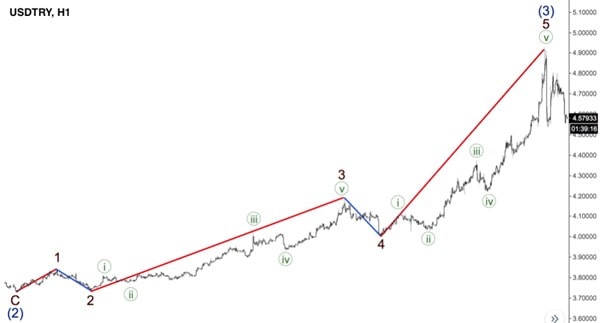

Look at an example below.

Motive Waves

There are two essential terms: motive and corrective waves. Both include unique Elliott Wave patterns. A motive wave reflects the price movement in the direction of the significant trend. Each motive wave consists of five small waves built according to different rules. Look at the motive patterns below.

Basic terms of the Elliott Wave strategy are corrective and motive waves.

Impulse

Like any other pattern, it consists of five waves. Three of them are motive, so they move in the direction of the prevailing trend; two others are corrective, they move in the opposite direction of the primary trend.

Each of the patterns has specific rules. Look at the rules of the impulse:

- An impulse wave consists of five waves.

- Wave 2 never outperforms the point where wave 1 starts.

- Wave 3 always crosses the high of wave 1.

- Wave 4 never exceeds the endpoint of wave 1.

- Wave 3 is never the shortest, among others.

- Wave 3 is an impulse wave.

- Wave 1 can be either an impulse or a leading diagonal pattern.

- Wave 5 can be an impulse or an ending diagonal pattern.

- Wave 2 shouldn’t be a triangle or a triple three structure.

An impulse wave signals a correction or even a trend reversal. We can find many impulse waves within one trend. Look at the example below. Green waves 1-2-3-4-5 is an impulse pattern. Also, blue waves 1-2-3-4-5 an impulse pattern.

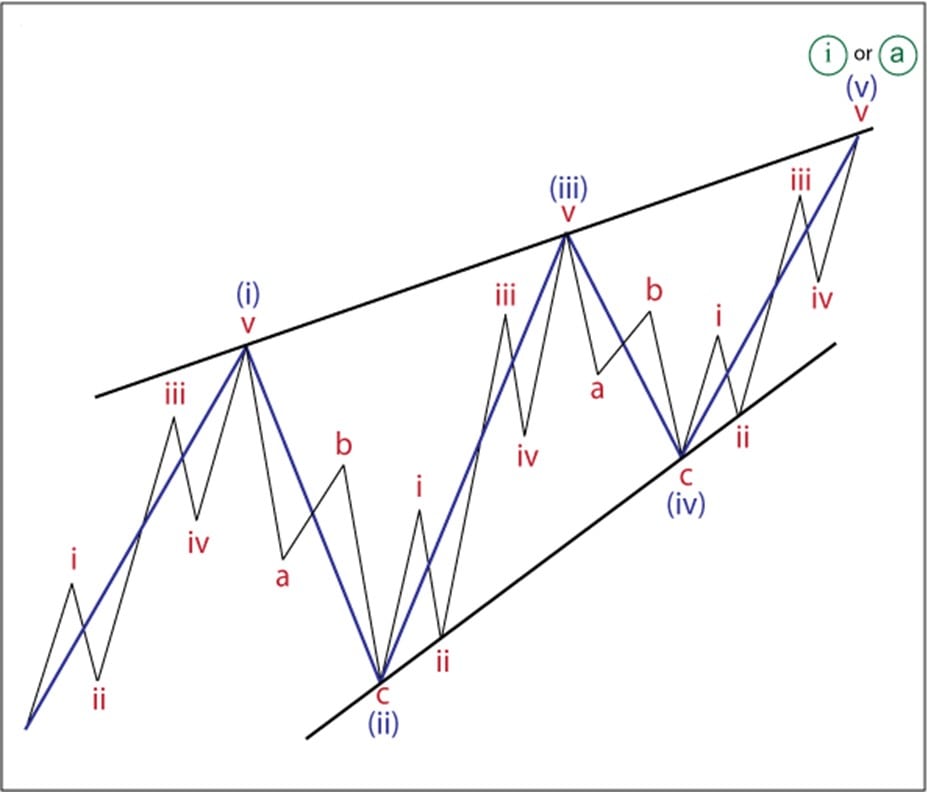

Leading Diagonal

This pattern is considered a beginning (wave 1) of an impulse or a zigzag.

Check the rules below:

- Leading diagonal has five waves inside.

- Wave 2 never exceeds the beginning of wave 1.

- Wave 3 always crosses the end of wave 1.

- Wave 4 usually outperforms the endpoint of the wave 1.

- Wave 5 usually passes the ending point of the wave 3.

- Wave 3 shouldn’t be the shortest one.

- Wave 2 shouldn’t be a triangle or a triple three structure.

- Waves 1, 3, and 5 can be impulses or zigzags.

Ending Diagonal

As the leading diagonal is the beginning of an impulse or a zigzag, the ending diagonal pattern is an end of them. The pattern includes different correction formations, such as zigzag.

- This pattern includes five waves.

- Wave 2 never outperforms the starting point of wave 1.

- Wave 3 always crosses the end of wave 1.

- Wave 4 usually exceeds the endpoint of wave 1.

- Wave 5 usually breaks the end of wave 3.

- Wave 3 shouldn’t be the shortest.

- Wave 2 shouldn’t be a triangle or a triple three structure.

- Waves 1, 3, and 5 look like zigzags.

Corrective Waves

Corrective waves follow motive ones. They are more complicated. A corrective wave is a step backward in a trend. Corrective waves also have several patterns.

ZigZag

Along with the flat pattern, ZigZag is a simple corrective formation.

The common rules:

- Zigzag has three waves.

- Wave A should be an impulse or a leading diagonal pattern.

- Wave B can be any correction pattern.

- The wave should be an impulse or an ending diagonal pattern.

- Wave B is supposed to be shorter than wave A.

- Wave C should be longer than wave B.

- Waves A and C are expected to be motive, but wave B should be corrective.

Flat

There are three different types of the flat pattern.

Follow the rules:

- The same as ZigZag, it consists of three waves.

- Wave A can be a correction pattern besides triangles.

- Wave B can be any correction pattern, but a zigzag is the most common one.

- Wave C is supposed to be an impulse or an ending diagonal.

- Wave B should be 90% longer than wave A.

- Wave C should be equal to or longer than wave B.

- Waves A and C are considered motives, while wave B should be corrective.

Triangle

Triangle is also a correction pattern, but it includes five, not three waves. There are many types of triangles. However, there are some rules for each triangle:

- Impulse Wave 2 isn’t a triangle.

- A, B, and C waves should be zigzag, double zigzag, triple zigzag (not too often), or double/triple three.

- D and E waves can be a triangle.

Double/Triple Three

We have mentioned the double/triple three patterns. Let’s clarify what it is. The pattern itself includes flat, zigzag, triangle, double/triple zigzags. Three correction patterns form a double three pattern.

The general rules for Double Threes trading:

- The pattern has three waves, which are named W-X-Y.

- Wave W can be any correction pattern, but not a triangle.

- Waves X and Y can be any correction pattern.

- Double three pattern is located horizontally or lower than the primary trend.

- Double three is not considered a deep correction.

Triple Three

As you see from the name of the pattern, it’s supposed to be longer than double three one. So, it has five waves (usually marked as W-X-Y-X-Z) that move horizontally against the prevailing trend.

Some rules of the triple three:

- Waves W, X, and Y are any correction pattern, but not a triangle.

- Wave 2 - X and Z – can be any correction pattern.

- Triple three is placed horizontally or lower than the major trend.

- The same as double three, triple three is a deep correction.

- This pattern rarely occurs. It’s not the best pattern to look at the chart.

Why to trade with Libertex?

- access to a demo account free of charge

- technical assistance to the operator 5 days a week, 24 hours a day

- leverage up to 1:500

- operate on a platform for any device: Libertex and Metatrader 4 and 5

- no commissions for extractions in Latin America