What Is Heikin Ashi and How to Use It in Trading

There are plenty of leading indicators that require particular installation, additional settings, and complicated calculations. However, not many traders know about one of the simplest indicators that depicts such well-known candlesticks. This indicator is Heikin Ashi.

What is the essential part of almost any trade? It’s crucial to find a trend. Heikin Ashi will help you to do that. Read on to learn how to get signals from one of the most straightforward forex indicators.

Heikin Ashi: The Basics

As you can see from the name of the indicator, it should somehow relate to Japan. If you translate Heikin Ashi from Japanese, you will get an "average bar." Every trader knows the famous Japanese candlesticks. No matter what security you trade, it’s more likely you will use the chart with Japanese candles. However, there are other chart types. And Heikin Ashi is one of them. Furthermore, this technique is both a chart type and an indicator.

Heikin Ashi candles look like the usual Japanese candlesticks, but remove market noise.

Munehisa Homma created this approach in the 1700s. Heikin Ashi candlesticks resemble usual Japanese ones. At the same time, the indicator makes the chart more readable and helps determine a strong trend. Would you like to know how it works? Look at the example.

Heikin Ashi Candles: Example

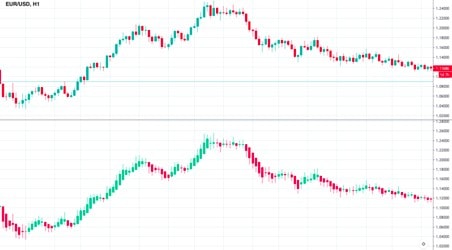

We prepared an example to ease the understanding. We took a 1-hour chart of the EUR/USD pair and applied the Heikin Ashi index to the chart with usual Japanese candlesticks.

The upper chart is the Japanese candlestick chart, the bottom one is the Heikin Ashi.

The Heikin-Ashi chart has a smooth effect, as it counts the movement of a price as the average. Moreover, if you look at the candlestick colors, you will see they don’t match. This happens because Heikin Ashi depicts the whole bullish trend in bullish color (green color on our charts) and the bearish trend in a bearish color (red color on our charts).

If you look at the candlewicks, you will see that most of the Heikin Ashi candles don’t have shadows. The lack of shadows signals a strong trend. The current price of the asset you trade may differ from the Heikin-Ashi one. Additionally, Heiken-Ashi charts don’t reflect price gaps.

Heikin Ashi: Learn the Core

To better understand the essence of the indicator, let’s consider several points that will clarify how Heikin Ashi works.

Let’s Calculate

The Heikin Ashi is mostly used to smooth the market and get rid of market noise. As we continue comparing Japanese candlesticks ad Heikin Ashi candles, let’s repeat, the Japanese candles show open, close, highest, and lowest points of the price for a specific period.

The aim of the Heikin Ashi is to serve as an trend indicator.

That’s why it needs a particular formula:

- To calculate the open price, you need to add open (previous bar) and close (last bar) prices and divide the sum by 2.

- To calculate the close price, you need to add open, high, low, and close prices, divide the sum by 4.

- To get the high, you need to get the maximum from high, open, or close of the current period.

- To get low, you need to get the minimum of the low, open, or close of the current period.

Even though the formula doesn’t look complicated, you won’t need to calculate any point as the indicator is built in automatically.

How to Implement It

The Heikin Ashi chart is inserted on all trading platforms. If we talk about MetaTrader, you should find the “Insert” window, click on the “Indicators” tab, choose “Custom”. Heikin Ashi will be on the list.

At the same time, Heikin Ashi can be implemented as a chart type. Switch Japanese candlesticks to Heikin Ashi.

Why to trade with Libertex?

- access to a demo account free of charge

- technical assistance to the operator 5 days a week, 24 hours a day

- leverage up to 1:500

- operate on a platform for any device: Libertex and Metatrader 4 and 5

- no commissions for extractions in Latin America