What are Blue Chip Stocks?

The term "Blue Chips” is often used to describe shares. However, many people do not know what blue chips shares actually are. In this article, we will look at the features of blue chip shares, at some examples and will discuss all the different ways to trade them.

Definition - What are blue chip shares?

Although there is no precise definition of what blue chip shares in fact are, the term is used to refer to the shares of well-established, profitable and big companies. In general, these are companies that have existed for a long time, offer well-known products and brands, and represent the market leaders in their respective industries. In addition, quite often such companies are multinational corporations with branches in many countries around the world.

The term "blue chip" has actually been borrowed from poker, because the blue poker chips have the highest value. The term was first used in the 1920s to refer to the shares of big, well-established and profitable companies.

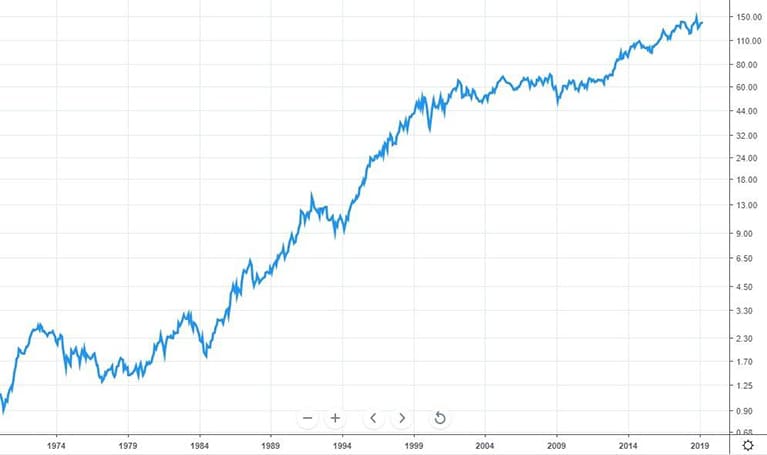

Most blue chip shares are constantly increasing in value and are considered to be stable/ In addition, they offer attractive dividend yields. They are different from speculative shares, many of which are volatile and not yet profitable.

Finally, almost all blue chip shares are included in the major stock indices, such as the Dow 30, S&P500 and FTSE 100.

Some examples of blue chip shares

Below you can find examples of well-known blue chip shares. This table shows a variety of shares in different industries that are considered blue chips. They are not necessarily the biggest or best blue chips, but a cross-selection of examples from different industries.

| Company | Share Price | Market capitalization ( billions) |

| Microsoft | $ 117.65 | $ 892 |

| Apple | $ 186.12 | $ 883 |

| Amazon | $ 1,761 | $ 852 |

| Johnson & Johnson | $ 137.60 | $ 369 |

| JP Morgan | $ 106.80 | $ 345 |

| Exxon Mobile | $ 80.87 | $ 343 |

| Visa | $ 154.59 | $ 336 |

| Walmart | $ 99.85 | $ 289 |

| Bank of America | $ 29.65 | $ 287 |

| Pfizer | $ 42.30 | $ 244 |

| Merck and Co. | $ 81.29 | $ 214 |

| The Boeing Company | $ 373.43 | $ 213 |

| Coca Cola | $ 45.46 | $ 196 |

| Walt Disney | $ 110 | $ 163 |

| McDonald's | $ 183 | $ 140 |

| Starbucks | $71.38 | $ 88 |

You will probably know most, if not all, of these companies. You might also notice that they are leaders in their respective industries, and most have been around for 40 years or even longer.

The pros and cons of investing in blue chip shares

It is very rare that blue chip companies go bankrupt. This means that there is less risk that the share price of a blue chip will not recover after a price decline.

These are companies that have an already proven business model and have used their retained earnings to grow further. Most of them also have a big competitive advantage. This makes it very difficult for other competitors to encroach on their market shares.

Unlike blue chip shares, shares that are not considered blue chips are often traded at prices that reflect their future potential and not the actual balance profits. If this potential is not realized, the share price must adjust at some point.

Big institutional investors invest most of their funds in blue chip shares, and they like to buy when the prices fall. This reduces the volatility of these shares and increases their liquidity.

The biggest drawback of blue chips is that they do not grow as fast as smaller, fast-growing companies. Every year there is a group of shares (usually shares of companies in the technology industry) that outperforms blue chips, though this performance comes with increased volatility and risk.

Finally, some blue chip companies are going bankrupt. The reason could be due to changes in technology or consumption trends. Manufacturers of analog cameras and car manufacturers are examples of companies that are not what they used to be. Many traditional retail chains are currently in a downward spiral.

For this reason, potential investors should always ask themselves whether there will be such an industry in the future before investing in a company in this sector.

How do you invest in blue chip shares?

There are several ways to invest in blue chips. Besides actually buying the shares, you can also buy CFDs, futures, options and even binary options on the respective share.

Click here to learn more about trading with shares.

Buying and owning blue chip shares

The traditional approach to invest in blue chips is to actually buy the shares of them and own them over a long period of time. That's what Warren Buffet, the most famous investor in the world, is doing.

There are some pros and cons to this approach. When you own shares in a company that makes steady profits over time, the company will reinvest those profits. This can lead to bigger revenues for the company, so the numbers could really go up a lot by doing this.

In case the dividend yield increases over time, you will eventually earn a very nice income in proportion to the amount that you originally invested.

However, there are some cons to this approach. First, it is not as easy to pick shares that will continue generating profits over a long period of time. Not all blue chips always generate money for their investors. Polaroid and Kodak were both once considered to be blue chips, but both ended up in bankruptcy.

Second, while blue chip shares typically generate steady gains over time, their average yields are lower than what you would receive for fast-growing shares with a shorter time horizon or through active trading of blue chip shares.

Conclusions

Blue chips can provide steady gains over time, but they also provide great trading opportunities for active traders. There are also many different instruments that can be used by traders to trade blue chips, depending on their personal style of trading.

Libertex is a broker and trading platform that offers CFDs on 50 American and European stocks, most of which are considered blue chips. In addition, clients can trade CFDs on commodities, indices, ETFs and cryptocurrencies with a leverage of up to 30. To try out what it is like to trade blue chip shares without risking actual capital, you can always open a demo account.

Why to trade with Libertex?

- access to a demo account free of charge

- technical assistance to the operator 5 days a week, 24 hours a day

- leverage up to 1:500

- operate on a platform for any device: Libertex and Metatrader 4 and 5

- no commissions for extractions in Latin America