What is Stop-loss and How to Use it in Trading

Setting a stop-loss order is one of the most important and mandatory actions when trading on Forex. The conditions of placing a stop order must be spelled out in the algorithm of each professional strategy. Otherwise, this strategy cannot be considered complete. However, some beginners who have just come to Forex, do not fully understand what stop-loss is and why it should be exposed. In this article, we will examine all of the main points related to a stop-loss order and consider several effective strategies for placing stop orders.

Stop-loss Definition

Stop-loss is an auxiliary order, which is set to protect a trader from serious losses in a particular transaction.

If the price goes in the wrong direction from which a trader expected movement, and the trade becomes unprofitable, the stop-loss helps save the stock.

When the price reaches the stop-loss level, the transaction closes automatically; a trader is able to save all the rest of the money and can begin developing a plan for the return of lost funds. A trader himself assigns a stop-loss level before opening a trade. Stop-loss is always tied to a certain price (with the exception of stop-loss on time, this case will be discussed later).

For example, if a trader opens a EUR\USD deal to buy at a price of 1.2500, then the stop-loss can be set at level 1.2490. It means that if the price goes down, and a trader starts to suffer losses, then the loss will be a maximum of 10 points. After that, the transaction will be closed, and a trader may make a new decision. For example, open a transaction for sale, if the trend of price reduction continues.

Why Use Stop-loss in Trading and How to Place it Correctly

Stop-loss must be set in order to minimize and control possible losses during trading. Even the best trading strategy periodically gives false signals, and opening trades with these signals leads to losses. Stop-loss helps to reduce these losses to a minimum, which allows a trader to quickly compensate for the lost funds and again get a plus.

Stop-loss can be set both at the time of opening the transaction, and later. It is better to place a stop order immediately because sometimes the price can make a sharp jump and move 20-30 points in just a few seconds.

If such a jump occurs in the opposite direction that a trader was expected, stop-loss will reduce losses many times. If a sharp price fluctuation occurs immediately after the opening of the transaction, in which the stop-loss was not set in advance (for example, a trader decided to do it a little later), the funds will be, to some extent, defenseless.

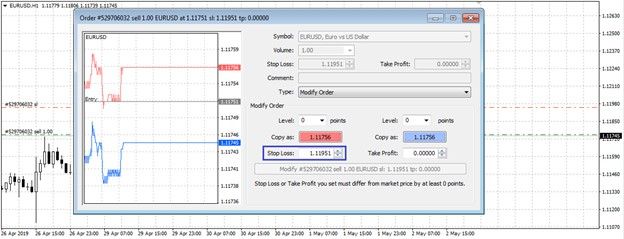

In practice, it is very easy to set stop-loss. For example, in the popular MetaTrader 4 trading terminal, this can be done in at least two ways:

- When opening a new order, enter the stop-loss level in the price level at which you would like to stop-losses and close the deal.

- When the deal is already open, you need to hold down the left mouse button by hovering the cursor over the order line and drag the line in the opposite direction to the open deal. For example, if you have opened a purchase transaction, you need to drag the line downwards, or upwards for a sale.

How to Calculate Stop-loss

There are many ways to calculate the size of the stop-loss for each specific transaction. In most professional trading strategies, it is already written, under what conditions, and at what distance from the opening price of a transaction, a stop should be placed. There are also several universal tactics for calculating and installing a foot – we will discuss them later in this article.

There is also one well-known rule that is recommended for all traders and for beginners in particular. The rule is this: losses in each individual transaction should not exceed 2% of the total capital. Based on this, you can calculate the stop-loss.

For example, a trader has a capital of 10,000 dollars and opens a EUR/USD transaction with a volume of 1 lot. The calculation is as follows:

- 1 lot EUR/USD = 100 000 EUR, one point of price movement will “cost” 10 dollars.

- 2% of the capital of a trader is 200 dollars.

- 200/10 = 20. So, a trader can afford a “drawdown” of a maximum of 19 points before forcibly closing deals and fixing a minus. The stop order must be placed at a distance of 20 points from the opening price of the transaction.

Why to trade with Libertex?

- access to a demo account free of charge

- technical assistance to the operator 5 days a week, 24 hours a day

- leverage up to 1:500

- operate on a platform for any device: Libertex and Metatrader 4 and 5

- no commissions for extractions in Latin America